PSD2 - Card Payment Verification

Recently, you might have noticed a change when shopping online? As well as the usual security checks performed when entering your payment details, there is now a further step required by banks before they will give the green light for your payment to be sent... PSD2, or in other words, Revised Payment Services Directive.

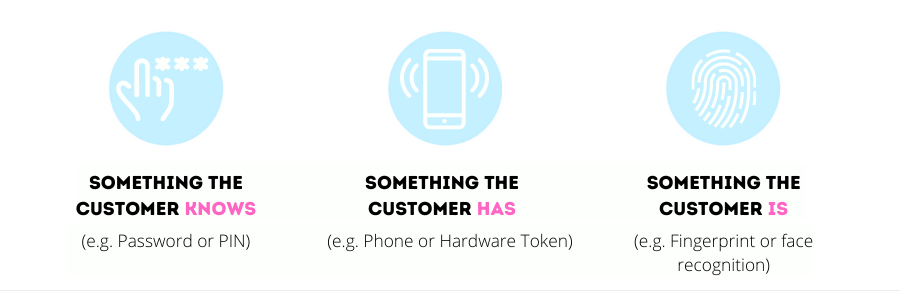

You probably don't recognise the name, but in short it is the EU legislation for electronic payment services that aims to make online card payments more secure in Europe. What it means for online shoppers, as part of the PSD2 regulation, is that two-factor authentication will be a requirement when making online card payments with ourselves and all other online retailers.

This is something that retailers will automatically offer at checkout through their payment provider. With many other forms of payment such as Paypal, Amazon, Apple and Google Pay already using certain forms of two-factor authentication, the main thing to remember is that it is done for your security and to help prevent and restrict online fraud... Despite initially feeling like yet another bridge to cross in the payment flow.

Each bank will provide their own version of this verification when confirming your payment at checkout and generally you will be offered the chance to verify your payment method using a variety of methods, depending on the details you have registered with your bank. The standard options are to receive a code to your registered mobile phone number or email address which is then entered at the online prompt or by logging in to your mobile banking app to prove you're making the payment.

Some customers may have already experienced these two-factor authentication requests during the last few years, but as it is now a pre-requisite rather than a choice for retailers and banks, you will be seeing it more and more regularly. If you do not have a mobile phone or the mobile banking app installed for your bank, it is probably the time to contact them for more information on how to register details for use during two-factor authentication checkouts.

It's not all bad news as some banks will give you the opportunity to register certain websites as 'safe' after you have verified them once, which will significantly reduce the need to enter verification codes in the future.